On March 8, 2010, SMN completed its initial public offering of shares and is now listed on the Indonesia Stock Exchange (IDX) with the stock code

About PT Sarana Menara Nusantara

SMN was established in Kudus, Central Java in 2008. The main focus of SMN’s business is to invest in the operating companies who own and operate tower telecommunication sites and fiber optic and lease them for telecommunication solutions including to telecommunication companies.

Since 2008, SMN’s main investment is its ownership of 99.99% shares of PT Profesional Telekomunikasi Indonesia (Protelindo). As the Company’s business activities are conducted primarily through Protelindo and major subsidiary iForte, the description of SMN’ business will be focused on the assets and operations of Protelindo and iForte. Any references to “our”, “us”, “we” or “the Group” refer to SMN, Protelindo, iForte and subsidiaries on a consolidated basis.

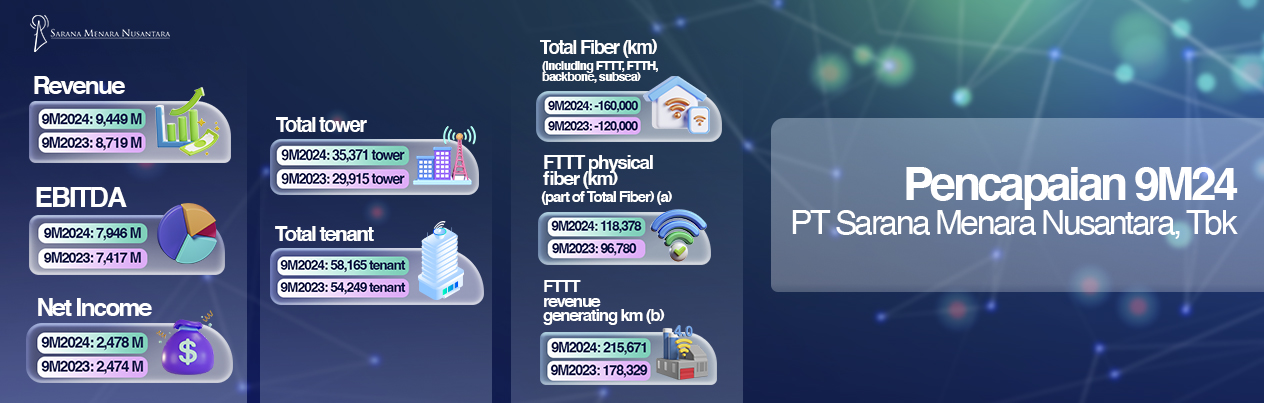

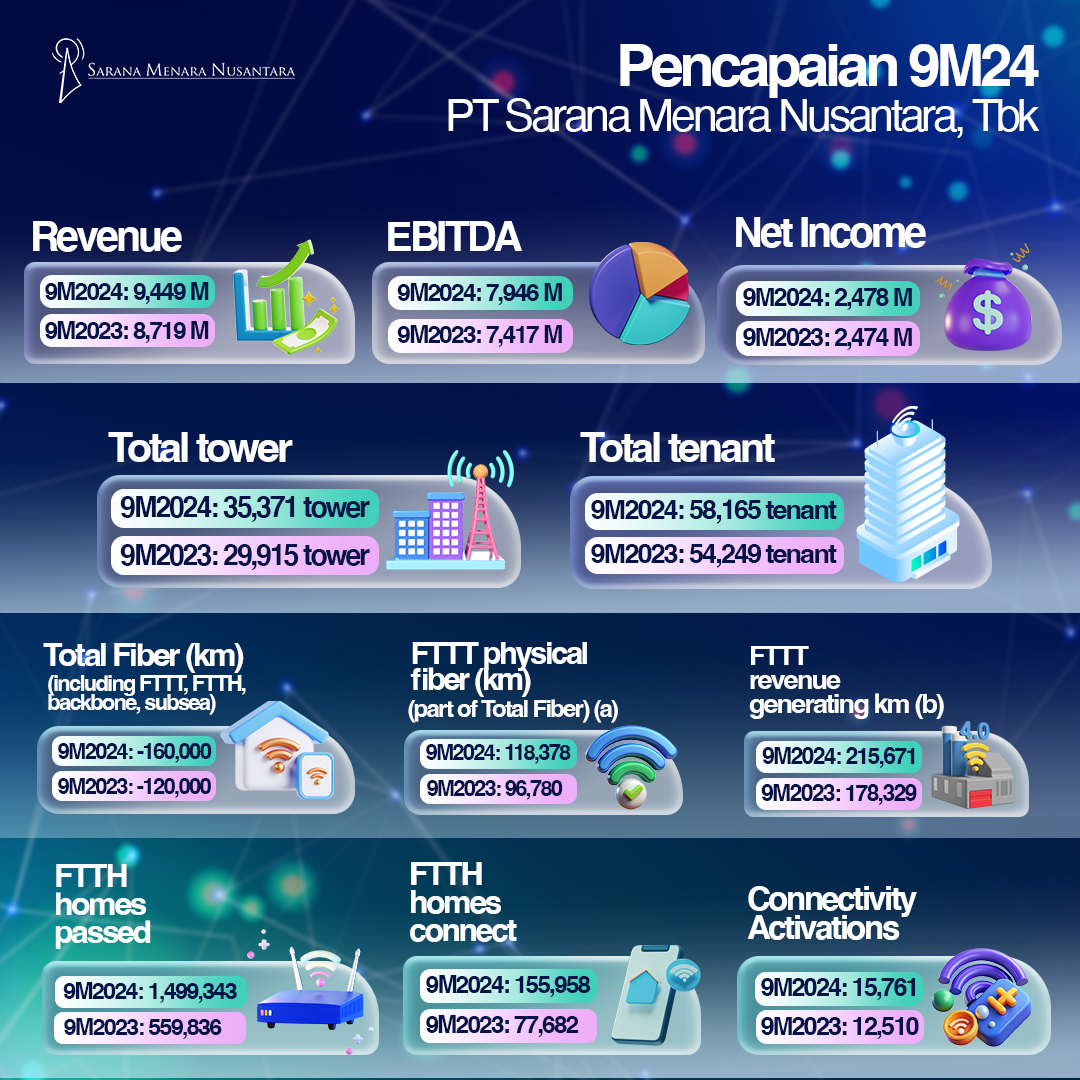

Established in 2003, we are one of the leading independent digital infrastructure companies in Indonesia. As of September 2024, we owned and operated approximately 35,371 telecommunication tower sites and ~160,000 km fiber optic network in Indonesia, primarily in Sumatra, Java, Bali, Kalimantan and Sulawesi.

Our common stock listed in IDX are those of SMN with stock ticker TOWR. TOWR shares is included in LQ45, IDX80, Kompas100, Bisnis-27, SMinfra 18, Investor 33, IDX SMC liquid as well as ESG stock indices such as ESGS Kehati, IDX LQ45 low carbon leaders, IDX SMC composite, IDX ESGL and MSCI Small Cap Index.

We are assigned an ESG rating by MSCI ESG of AA.

(Status 3Q24)

“

We are committed to contributing to the growth and success of Indonesia’s telecommunication infrastructure sector. This vision has led us to diversify our business, transforming the Company into "Indonesia’s only private sector digital infrastructure company

CEO MessageFerdinandus Aming Santoso

President Director